How to Buy Your First Home

At Millennial Economics, we believe real estate can be a key building block in your financial journey. Not only can buying your first home be fun and rewarding but if you equip yourself with the right knowledge the home you buy can also be a great asset for years to come.

I have personally bought two homes before the age of thirty. I have a passion for real estate and have both experienced and observed what to do right and what to do wrong when buying your first home. In this article, we will discuss the steps you need to take to buy your first home in 2021.

5 Steps to Buying Your First Home in 2021

Analyze Your Finances

You may be asking yourself, “How much money do I need to make to buy my first home?”. The answer to that isn’t as clear as you might think. There isn’t necessarily a specific amount of money you need to make to qualify for a home loan, but there are a few things lenders look at to determine if you are a good candidate.

Lenders will look at many things when taking you through the approval process for a mortgage. Debt to income ratio and your credit score are two things that weigh heavily in the decision-making process.

Debt to income ratio is the ratio of money you pay towards debt every month compared to your monthly income. Lenders typically look for a front end debt to income ratio of less than 28% and a back end debt to income ratio of less than 36%.

Front End Debt to Income Ratio - The percentage of your mortgage compared to your income.

Back End Debt to Income Ratio - The percentage of all monthly debt obligations compared to your income.

Lenders typically work with borrowers with a credit score of at least 640, with the best rates going to borrowers with a credit score of 740+.

It is a good idea to understand what the banks look at when approving someone for a mortgage, but I believe in taking things a step further and analyzing how much house you can afford for yourself. After all, the banks don’t know your money as well as you do. I have seen time and time again the amount someone is approved for being far beyond the amount they should actually purchase.

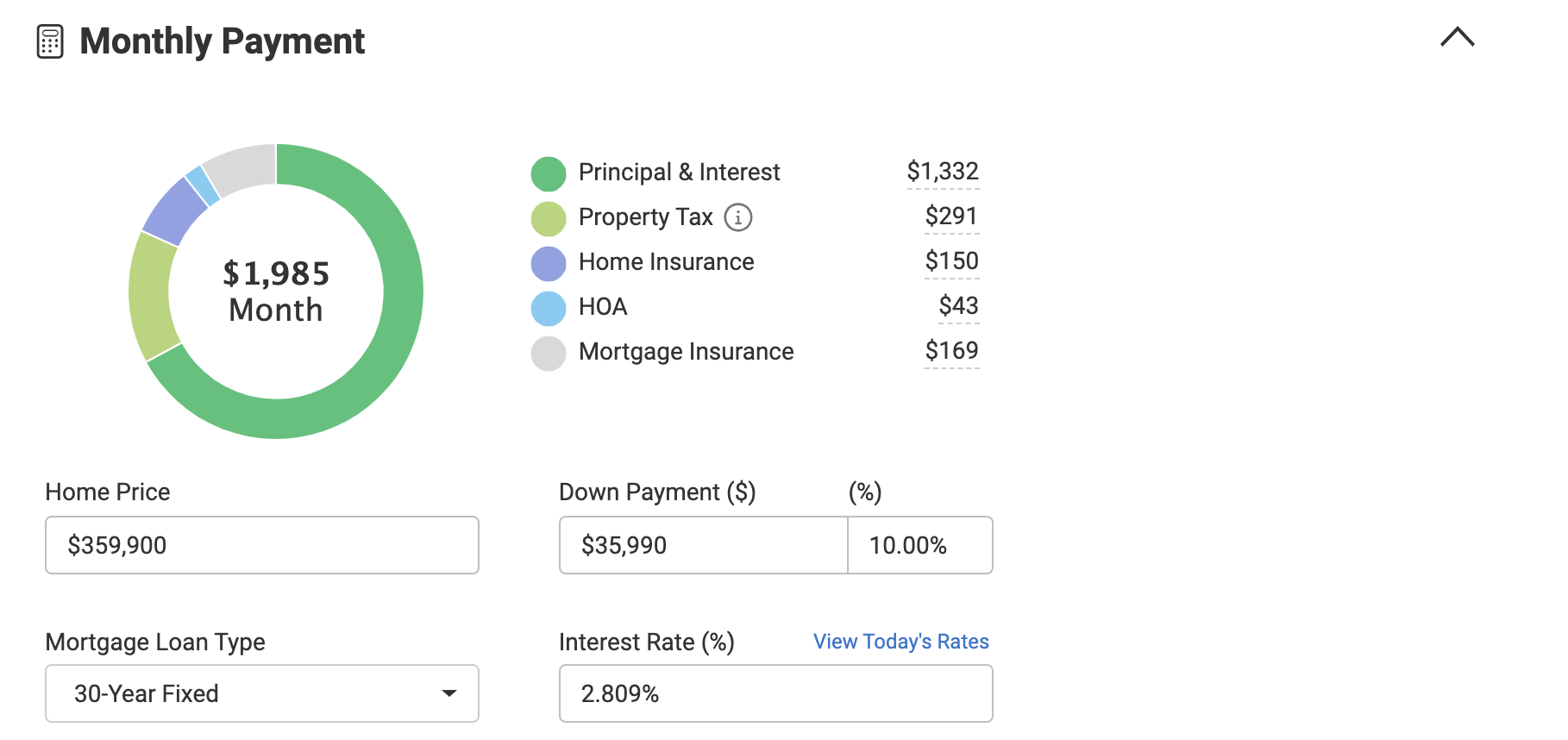

Before you pursue being pre-approved for a mortgage, take a look at your budget and decide what you are comfortable paying. List your after tax income, deduct all expenses, and continue deducting for saving and investing. Once you have done this, decide what you are comfortable paying per month for your mortgage, and remember, you don’t just pay for your mortgage when you are buying a house. You will also be paying home insurance, property tax, and maybe even miscellaneous fees like an HOA or Private Mortgage Insurance (PMI). Often these things can add up very quickly, so make sure you are taking them into account.

Take a look at this screenshot from realtor.com. All of these fees will be paid monthly with your mortgage.

2. Credit Score

Lenders typically work with borrowers who have credit scores above 640, with the best rates going to borrowers with a credit score of 740+. There is an option for those of you with no credit score to get approved for a mortgage. This involves manual underwriting. I would encourage you to do a bit of research on that if you find yourself with no credit score at all. For those of you with a low credit score, below 640, you will be better served to increase your credit score before applying for a mortgage.

3. Down Payment

There are many types of home loans, with each having a different down payment requirement. These percentages range from 0% to 20%+.

FHA loan - 3.5% Down

VA loan - 0% Down

USDA loan - 0% Down (Geographical requirements)

Conventional loan - 3%+

In most cases, I recommend going to closing with at least a 10% down payment, with 20% being preferable. Putting at least 10% down on a home will help you have a bit of equity from the start, and putting 20% down will keep you from Private Mortgage Insurance (PMI), which is a fee you pay every month that goes directly to the lender. None of this fee actually goes to the balance of your mortgage.

There are cases where you can avoid PMI without putting 20% down, but I would encourage you to talk to your lender to see what type of loan is right for you.

4. Find a Trusted and Experienced Realtor

Most of us have a friend or family member that is a realtor. In most cases, I would recommend you NOT work with a friend or family member to buy your first home unless they have a long track record of success in the profession. I see so often people working with a family member or friend simply because they have a license to sell real estate. Deciding on a relator this way could be a big mistake.

Do your research and go with a realtor who has a long track record of successfully buying and selling homes for their clients. You will be glad you did.

5. Pick the Right Home

Picking the right home, especially if you are a first time home buyer, is so important. Some things to consider:

How much space do I need/want?

What is my ideal location?

What features am I looking for?

How far am I willing to commute to work?

Will the property value of the home increase or decrease over time?

Answering these questions thoroughly will help you make a sound purchasing decision. One thing to remember is you can always improve a house, but you cant improve its location. If you purchase a beautiful home and it is far away from everything or is in a less desirable neighborhood you might end up stuck with a beautiful home that is hard to sell. It is easy to become infatuated with a beautiful home that doesn’t make practical sense because of its location. It is important to analyze what is most important to you and not waiver on those things.

I would also recommend buying your first home with the understanding that you will most likely sell that home within 4-7 years. So much happens in the years after you buy your first home. Buy with the understanding that you will be selling eventually. What does this mean? Purchase a home that you can invest a little sweat equity into to increase its value. Also, look to buy in a desirable neighborhood. Buying a home that can make you money down the road is so important. If you take this seriously you will be so happy you did.

Read our article: How I Get Instant Equity on My Home Purchases

Summary

I hope you found the information in this article valuable, and that you learned a bit about how to buy your first home. If you follow these principles you can make the home buying process a blessing and not a curse.

Happy house buying!

Continued Reading

How to Become Financially Successful in 2021

How to Start Investing in 2021 for Beginners

How to Get Out of Debt in 2021